News

Altria is an excellent income play for long-term investors.

Via The Motley Fool · January 30, 2026

Silver prices may be volatile, but miners of the precious metal should see expanding profit margins.

Via The Motley Fool · January 30, 2026

First Hawaiian FHB Earnings Call Transcript

Via The Motley Fool · January 30, 2026

The gold and silver prices are in the midst of one of their largest (at least by dollar amount) moves downward, which the Wall Street media is attributing to the nomination of Trump’s new Fed chair candidate.

Via Talk Markets · January 30, 2026

The financial services company's share price has plummeted in the past year. Is it cheap enough to buy?

Via The Motley Fool · January 30, 2026

The U.S. equity market has just completed a rare stretch: three consecutive years of double-digit returns. Periods like this are celebrated — and rightly so, but history suggests they should also prompt reflection. Extended runs of strong performance often lead investors to over-concentrate on what has worked best, precisely when diversification becomes most valuable. Exposure naturally drifts toward recent winners, portfolio balance erodes slowly, and return expectations become anchored to conditions that may no longer persist.

Via PulseBulletin.com · January 30, 2026

Following a turbulent period of political gridlock and fiscal uncertainty, new data released by the U.S. Census Bureau on January 21, 2026, reveals that U.S. construction spending rose by 0.5% in October 2025. This increase brought the seasonally adjusted annual rate to $2.175 trillion, a figure

Via MarketMinute · January 30, 2026

People tend to overrate the importance of Fed chairs, as the Fed has a great deal of institutional inertia.

Via Talk Markets · January 30, 2026

The Conference Board’s Leading Economic Index (LEI) recorded a 0.3% slip in its latest reading, signaling a cooling trajectory for the United States economy as it enters the new year. This downturn, reported in January 2026, marks a pivotal moment for markets that have been grappling with the

Via MarketMinute · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

Cavco (CVCO) Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 30, 2026

WASHINGTON D.C. — The global currency markets have been sent into a whirlwind this week as the U.S. Dollar staged a powerful recovery against the Japanese Yen. The surge followed definitive comments from U.S. Treasury Secretary Scott Bessent, who effectively shut the door on rumors of a coordinated

Via MarketMinute · January 30, 2026

The U.S. bond market is witnessing a significant recalibration as the 10-Year Treasury yield climbed to a pivotal 4.24% today, January 30, 2026. This surge, fueled by a combination of persistent "low-grade fever" inflation and heightened geopolitical friction, was further solidified by President Donald Trump’s official nomination

Via MarketMinute · January 30, 2026

The U.S. housing market faced a chilling end to 2025 as the National Association of Realtors (NAR) reported a staggering 9.3% plunge in pending home sales for December. This sharp month-over-month decline pushed contract signings to their lowest level since the onset of the COVID-19 pandemic in 2020,

Via MarketMinute · January 30, 2026

The United States labor market once again demonstrated its remarkable durability as initial jobless claims for the week ending January 24, 2026, fell to a seasonally adjusted 200,000. This figure arrived significantly lower than the consensus forecast of 206,000, signaling that despite high interest rates and a cooling

Via MarketMinute · January 30, 2026

The global precious metals market suffered its most violent "flash crash" in recent history today, January 30, 2026, as a "perfect storm" of hawkish U.S. monetary policy signals and massive technical liquidations erased months of gains in a matter of hours. Gold prices, which had reached a staggering peak

Via MarketMinute · January 30, 2026

President Trump's nominee let Wall Street breathe a sigh of relief, but that's not great for gold prices.

Via The Motley Fool · January 30, 2026

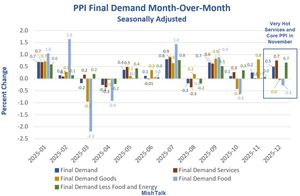

The U.S. economy was met with a stark awakening on January 30, 2026, as the Bureau of Labor Statistics released the December 2025 Producer Price Index (PPI) report, revealing a significant and unexpected jump in wholesale inflation. Headline PPI rose by 0.5% on a month-over-month basis, more than

Via MarketMinute · January 30, 2026

Wall Street etched a new chapter in financial history this week as the S&P 500 index briefly surged past the 7,000-point threshold for the first time, marking a breathtaking ascent that has redefined investor expectations for the decade. On January 28, 2026, the benchmark index touched an intraday

Via MarketMinute · January 30, 2026

In a move that signals a seismic shift in American monetary policy, President Donald Trump has officially nominated former Federal Reserve Governor Kevin Warsh to succeed Jerome Powell as the Chair of the Federal Reserve. The announcement, made on January 30, 2026, marks the beginning of the end for the

Via MarketMinute · January 30, 2026

Fed Governor Stephen Miran praised the nominee Kevin Warsh and said he is in favor of rate cuts, whereas Federal Reserve Bank of St. Louis President Alberto Musalem said officials should hold off from lowering interest rates further.

Via Stocktwits · January 30, 2026

Gold fell 9.5% and silver collapsed 27%, sparking a mining stock bloodbath as markets repriced Fed risk after Trump named Kevin Warsh as chair.

Via Benzinga · January 30, 2026

Yesterday, Jerome Powell prematurely praised a decline in services inflation.

Via Talk Markets · January 30, 2026

Webull’s stock slid over 3% on Friday, to clock an all-time low of $6.96 in intra-day trading.

Via Stocktwits · January 30, 2026

CORAL SPRINGS, Fla. - Jan 30, 2026 - The Internal Revenue Service is expanding automated tax collection systems that could accelerate bank levies, wage garnishments and federal tax liens for delinquent taxpayers, tax professionals and policy analysts said, as the agency deploys data-driven enforcement tools following a multibillion-dollar modernization push.

Via AB Newswire · January 30, 2026