MercadoLibre has had an impressive run over the past six months as its shares have beaten the S&P 500 by 27.7%. The stock now trades at $2,416, marking a 31.7% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is MELI a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On MELI?

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

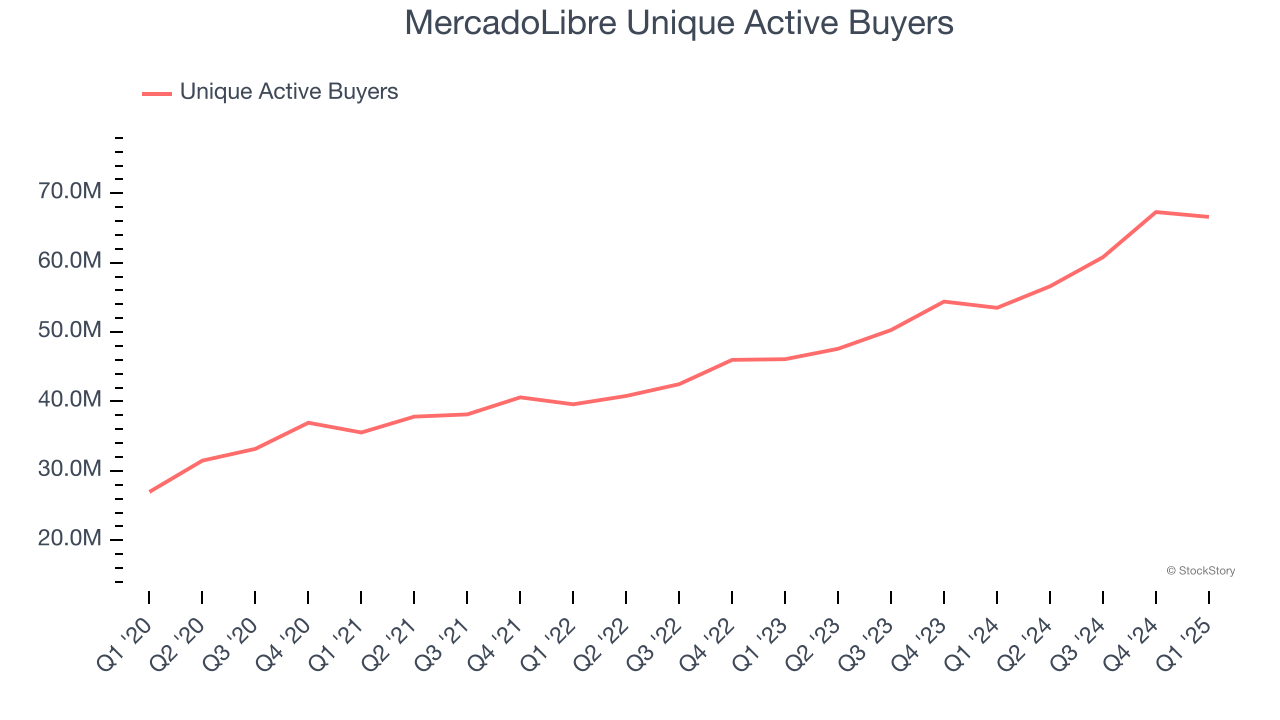

1. Unique Active Buyers Skyrocket, Fueling Growth Opportunities

As an online marketplace, MercadoLibre generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, MercadoLibre’s unique active buyers, a key performance metric for the company, increased by 19.7% annually to 66.6 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

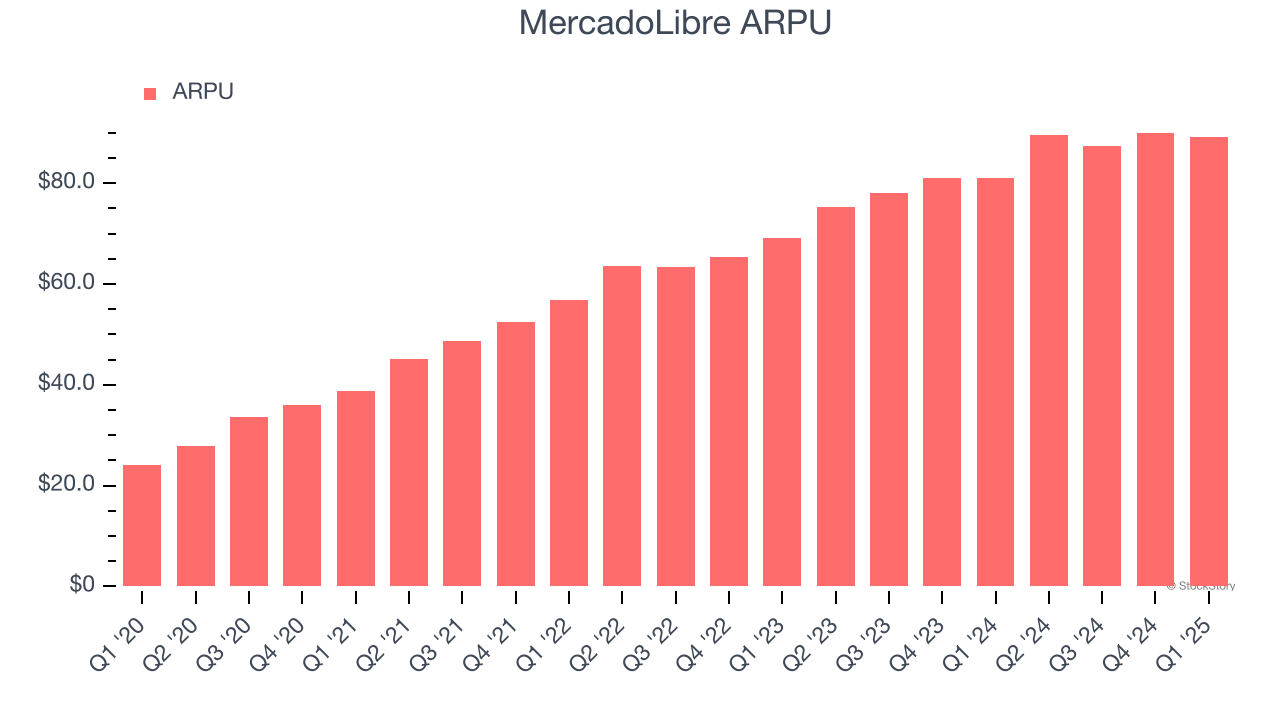

2. Eye-Popping Growth in Customer Spending

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and MercadoLibre’s take rate, or "cut", on each order.

MercadoLibre’s ARPU growth has been exceptional over the last two years, averaging 16.9%. Its ability to increase monetization while growing its unique active buyers at an impressive rate reflects the strength of its platform, as its users are spending significantly more than last year.

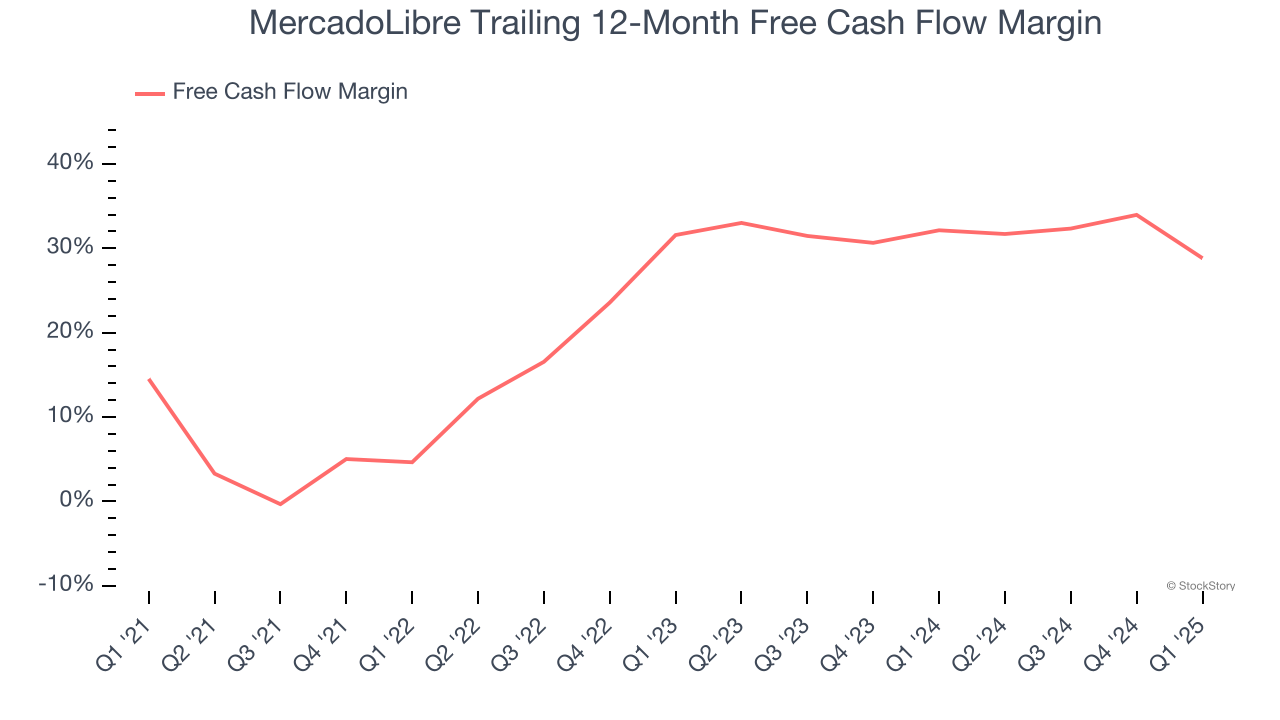

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

MercadoLibre has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 30.2% over the last two years.

Final Judgment

These are just a few reasons why we're bullish on MercadoLibre, and with its shares outperforming the market lately, the stock trades at 28.1× forward EV/EBITDA (or $2,416 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than MercadoLibre

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.